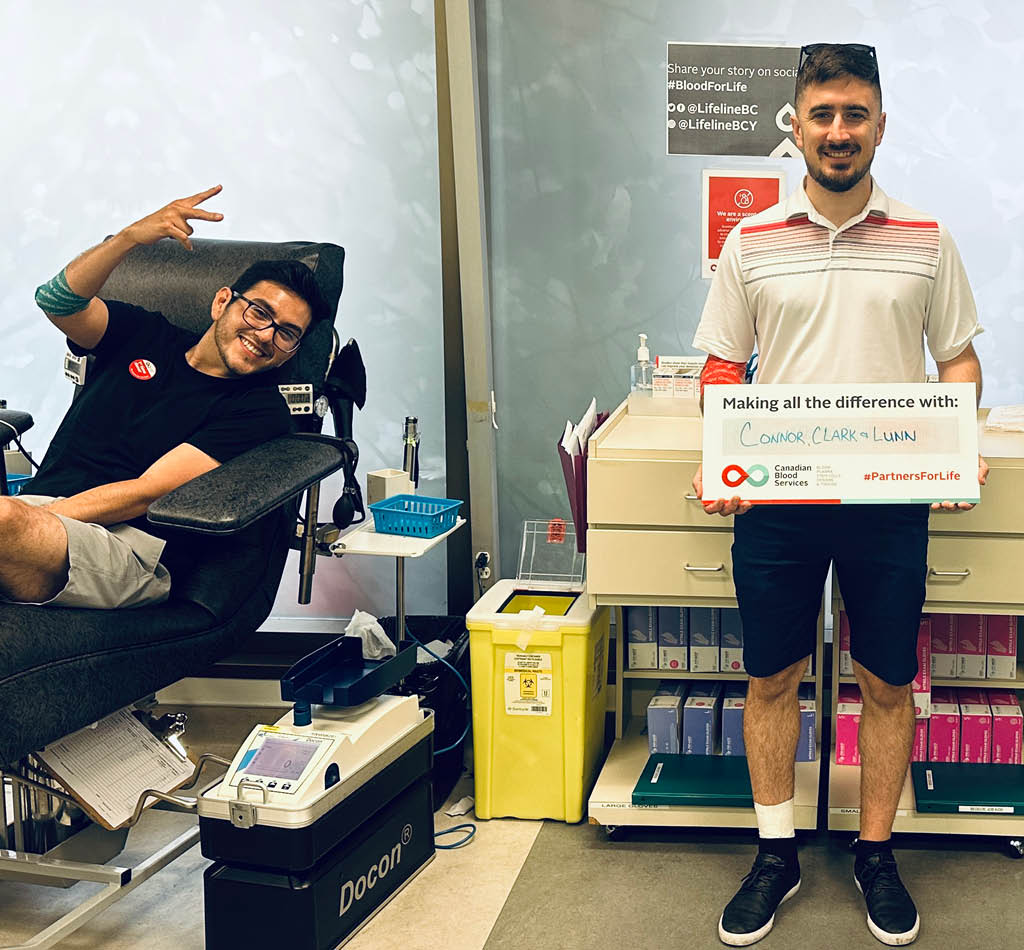

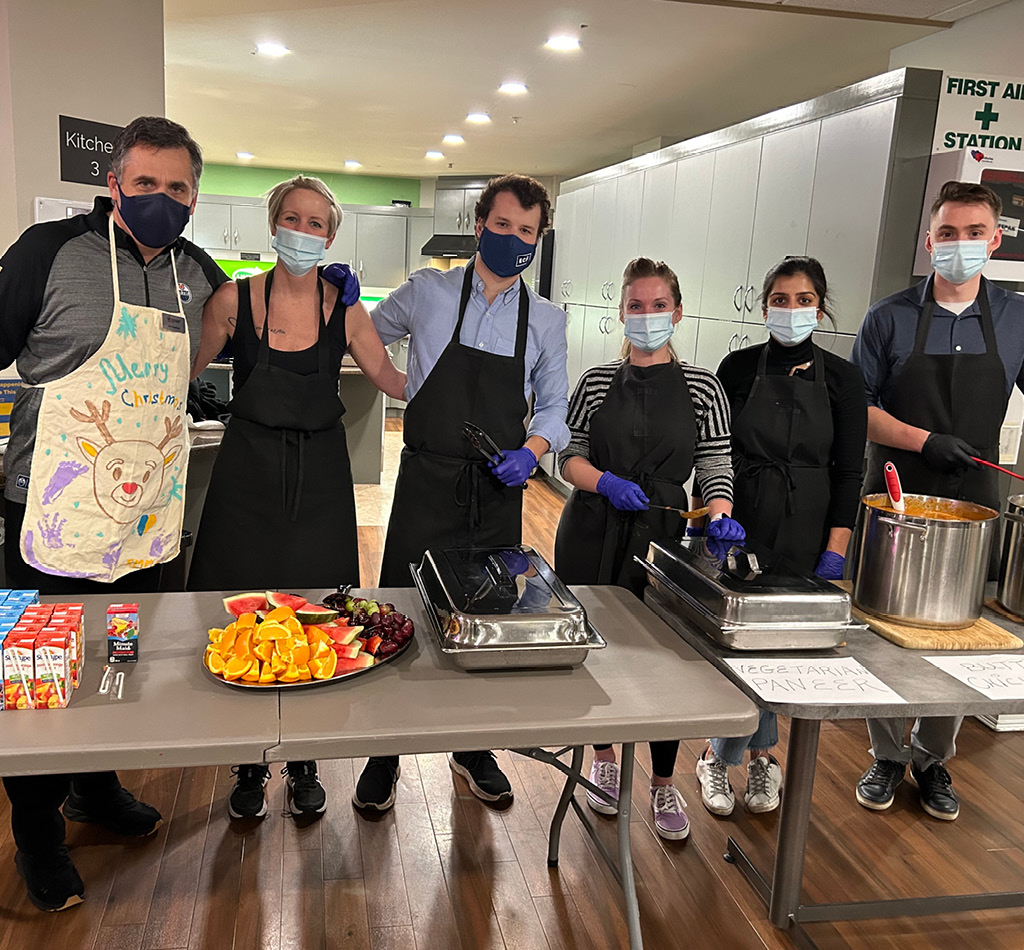

Supporting Canadian Blood Services and enhancing community impact through partnership

The CC&L Foundation is pleased to announce a contribution to Canadian Blood Services, exemplifying our commitment to community and creating a positive impact.

Our strategy is designed to provide preservation of

capital with low correlation to market returns.

Senior Vice President,

Head of Institutional Sales, Canada

Tel: 416-364-5396

Email: [email protected]

Senior Vice President,

Co-Head of Institutional Sales, USA

Tel: 917-945-0960

Email: [email protected]

Director,

Institutional Sales, Europe

Tel: 44 (0)203-535-8107

Email: [email protected]

The CC&L Foundation is pleased to announce a contribution to Canadian Blood Services, exemplifying our commitment to community and creating a positive impact.

As Pride Month draws to a close, the CC&L Foundation and employees successfully raised $13,200 for Rainbow Railroad.

The Connor, Clark & Lunn Foundation commits $125,000 to provide support for Ronald McDonald House Charities Alberta, an organization that provides accommodations to families who must travel for medical treatments for their seriously sick or injured child.

The ongoing conflict in Ukraine has displaced over 12 million Ukrainians, with many seeking refuge in neighbouring countries and beyond. The CC&L Foundation has stepped up to provide vital humanitarian aid.

The CC&L Foundation has donated to the Daily Bread Food Bank in Toronto for a number of years and has recently furthered support with a multi-year commitment.